October 1, 2021

By:

Julia Jensen Smolka

At the beginning of the pandemic, attorneys like myself who work in bankruptcy and collection courts were worried that they would be flooded with too many cases.

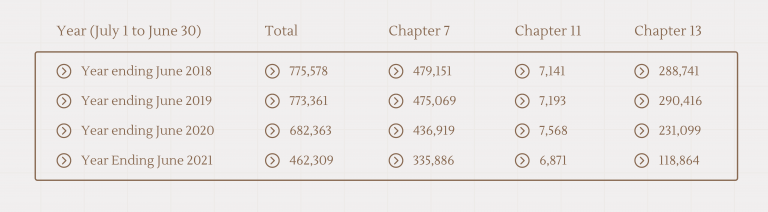

Businesses were shutting down, and people were out of work. Those events typically lead to debt collection lawsuits, bankruptcy, evictions, and foreclosures. But through the pandemic, that has not been the case. Legal proceedings, like evictions, foreclosures, and wage garnishments were stopped by Governor Pritzker. Evictions have slowly resumed, as have foreclosures and certain debt collection. But bankruptcies are staying at historic lows. Below are national figures for bankruptcy before and during the pandemic by chapter.

Whether it was the various moratoriums that were enacted, the stimulus checks that were sent by the federal government, or the additional unemployment compensation, bankruptcies overall are down over 40%. As the moratoriums end, and the additional unemployment benefits end, bankruptcy might be an option for you or a family member. If you’re a creditor and would like to discuss evictions or collections, or if you are a debtor and need financial assistance, please contact Julia Smolka at jsmolka@robbinsdimonte.com.